SC forms Committee to draft Mediation Law

12th January 2020

Mediation Setting Should Balance Social Power; Not Promote A Culture Of Impunity: Justice Chandrachud

10th July 2021

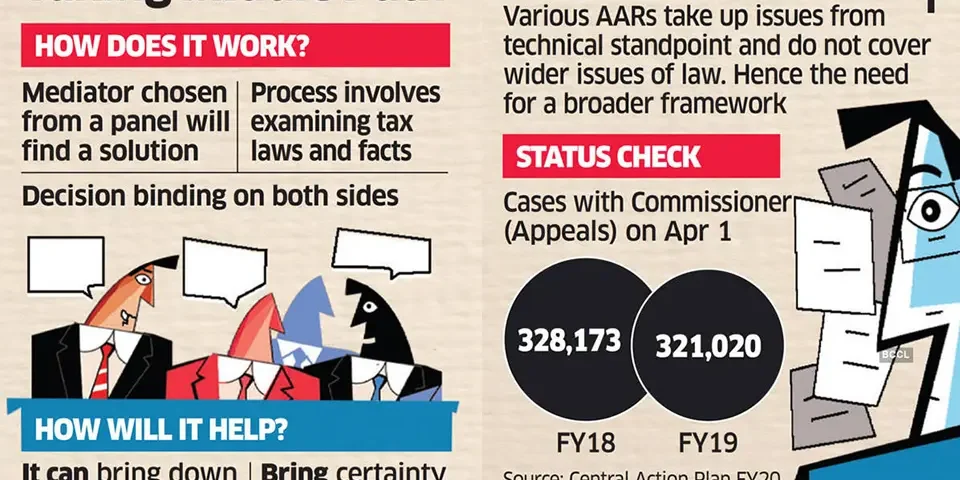

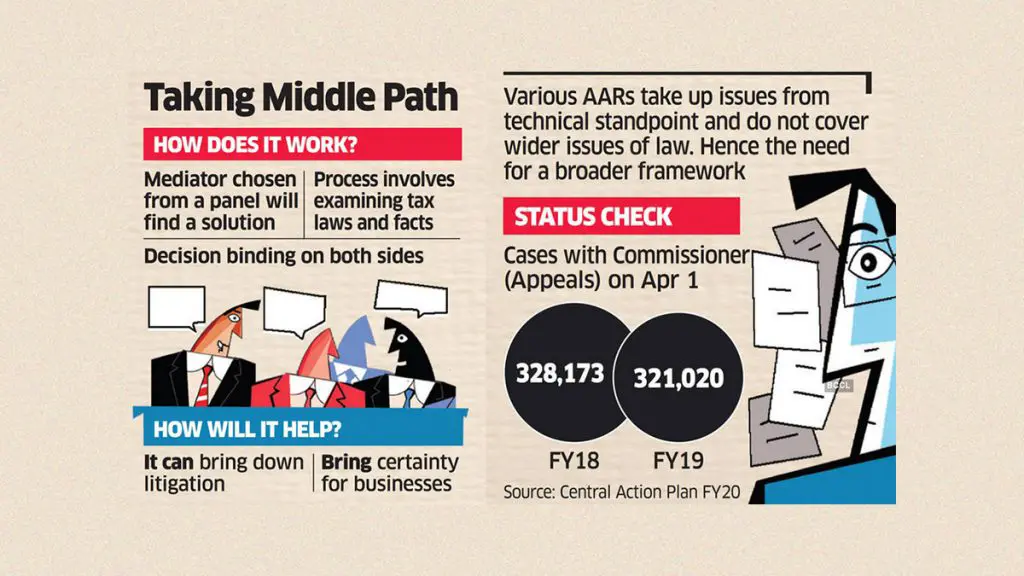

A news report quoting government officials suggests that the government is contemplating the adoption of a mediation mechanism that will help companies determine their future tax liabilities and even settle tax disputes through a neutral mediator.

Sources involved with the preparation of the 1st Feb Union Budget suggest that the mediation process would require examining tax legislation and all relevant facts in detail; and neutral mediators, chosen from a panel, will negotiate and arrive at a settlement, which will be binding on both sides.

This is a welcome move, given that the Government is the largest litigant in the country, and disputes with Tax-related departments place a huge burden on individuals and businesses across the country.

While legislation can be defined in this regard, many other questions arise. Questions that not only pertain to process, but also departmental culture and mindsets of people involved.

For example:

- What kind of mediators will comprise this panel for IT related mediation?

- Will Mediators only be chosen from the Court-Annexed Mediators roster?

- Will Private Mediators trained by various industry bodies be included?

- What will be the remuneration structure?

- Will individuals that represent the Govt/ITD be truly empowered to settle disputes?

Most importantly, it raised two critical questions of us being able to overcome two major mindset challenges:

Will the sizeable tax-evading business mindset get emboldened by a perceived “softer” dispute resolution method, and try to exploit it?

Will tax authorities be able to set aside their unilateral Sarkari approach to dispute resolution, and submit to an everyone-equal mediation process?

Whether this move is feasible, or just fantasy, remains to be seen. We sincerely hope, it becomes a feasible fact of life going forward.

To read the full news report, via Economic Times, please click here.